At Monday’s talks, the United States and China examined large challenges facing the global economy amid growing speculation that some Trump-era tariffs might be cancelled in order to minimize inflation and encourage growth.

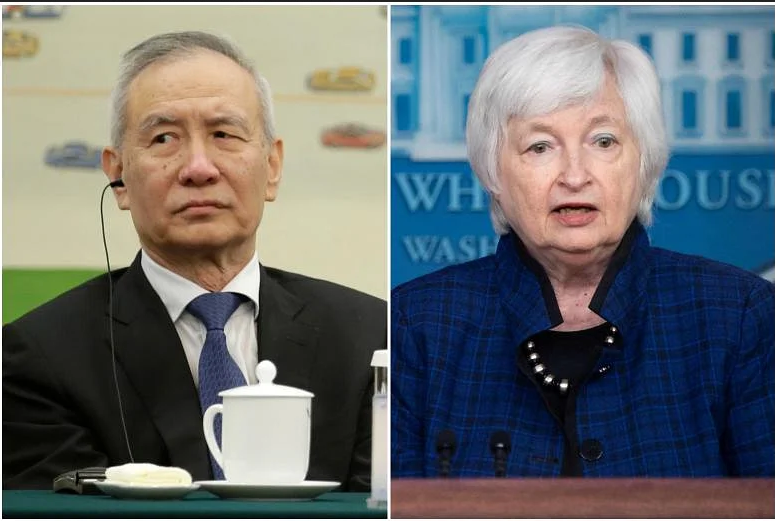

US Treasury Secretary Janet Yellen and Vice Premier Liu He of the People’s Republic of China had a “substantive conversation” over the phone, according to a pledge by the US Treasury.

The reactions of each country arrested by the investigations have been seen as “candid” and as Business Insider and The Bloomberg and Wall Street Journal report that the Biden administration may lift some tariffs previously imposed on Chinese goods as soon as this week.

The Chinese readout noticed that the trade was “helpful” and “sober minded.” It added that the different sides talked about “sees on the macroeconomic circumstance and the dependability of the worldwide modern chain and production network.”

The two sides concurred that the worldwide economy is confronting serious difficulties, and set “incredible importance” on better approach coordination among China and the United States, it added.

From the World Bank to Wall Street, there is a developing worry about the gamble of a worldwide downturn, and expansion not found in many years is pounding customers in the United States and Europe.

China’s economy, in the interim, has been battered by the nation’s zero-Covid strategy. Experts stress that the Chinese economy could contract in the subsequent quarter, putting the public authority’s yearly development focus of 5.5% for 2022 far off.

The Chinese side too “communicated its anxiety over issues, for example, the lifting of extra duties and assents forced by the United States on China and fair treatment of Chinese organizations,” as per the Chinese assertion.

The US readout didn’t specify duties or authorizes yet expressed that Yellen “raised issues of concern” remembering the effect of Russia’s conflict against Ukraine for the worldwide economy and what it referred to China’s as’ “unreasonable, non-market” financial practices.

The call between the two senior financial authorities comes after Bloomberg revealed Monday that Biden might declare a “rollback of certain US duties on Chinese buyer merchandise” this week.

The report, which refered to anonymous sources, said the move is seen “as a method for countering speeding up expansion.”

The Wall Street Journal additionally said Monday that Biden might settle on Chinese duties this week, refering to individuals acquainted with everything going on, however added that the choice is “compelled by contending strategy points: tending to expansion and keeping up with monetary tension on Beijing.”

The White House didn’t promptly answer a solicitation for input.

“The timing checks out,” said Jingyang Chen, Asian unfamiliar trade specialist at HSBC, highlighting the fourth commemoration on July 6 of the beginning of previous President Donald Trump’s exchange battle with China

On that day in 2018, US taxes on $34 billion worth of Chinese imports produced results. From that point forward, pressures have tightened up decisively, with the different sides forcing steep new taxes on billions of dollars of one another’s products.

Following a very long time of dealings, an exchange détente was endorsed in January 2020. Yet, respective relations have stayed tense under the Biden organization.

In any case, spiking expansion in the United States has powered assumptions that the organization will facilitate a portion of the duties to assist with checking rising costs.

A cut in US taxes is “around the bend,” said Ken Cheung, boss Asian unfamiliar trade planner at Mizuho Bank, on Tuesday.

The Biden organization has “solid political inspiration” to ease taxes to cut down expansion before the mid-term races in November, he added.